How to Use Amazon Lending to Grow Even Faster in 2022

On February 9, 2022, Cahoot brought together experts from Perch and Payability to explore a question on eCommerce sellers’ minds: how can you stay ahead of your intensifying competition?

Sellers and money are pouring into eCommerce, and especially Amazon. Consider this – by the end of 2022, Payability estimates that there will be a whopping 11,000,000 3rd party sellers on the marketplace.

If you’ve been in the industry for a while, you can fondly remember a time not too long ago when you could find an undervalued product niche, launch a private label product a few weeks later, and watch sales slowly but surely grow. Unfortunately, those days are long gone. 1,000,000+ sellers join Amazon every year, and on top of that, the existing competition is getting bigger and much better funded.

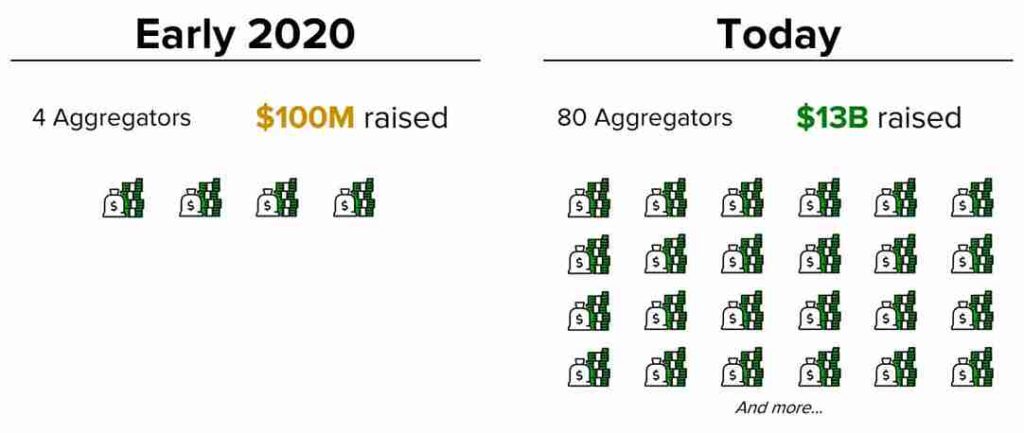

You’re not just going up against other small sellers anymore – aggregators have sprung up out of nowhere to raise over $13 billion in funding in just two years. Aggregators like Perch buy promising brands, and then they turbo charge them with huge infusions of cash and seasoned Amazon operators. No matter what you’re selling, you’ll be up against sellers backed by millions in cash that are hungry for growth.

If you don’t fight fire with fire, your well-capitalized competition will push you out of the buy box and leave you with a heap of unsold inventory. How can you compete in this new, tough world?

Amazon Lending Keeps You Selling

Thankfully, small sellers can improve their access to cash with providers like Payability. Most, if not all sellers know the pain of waiting on an Amazon payout for weeks while money for ads dry up, and payment solutions will solve that challenge for you. It’s not just about advertising, though – Jack Howard walked our audience through all of the powerful ways you can use even a small improvement in your access to capital to boost growth.

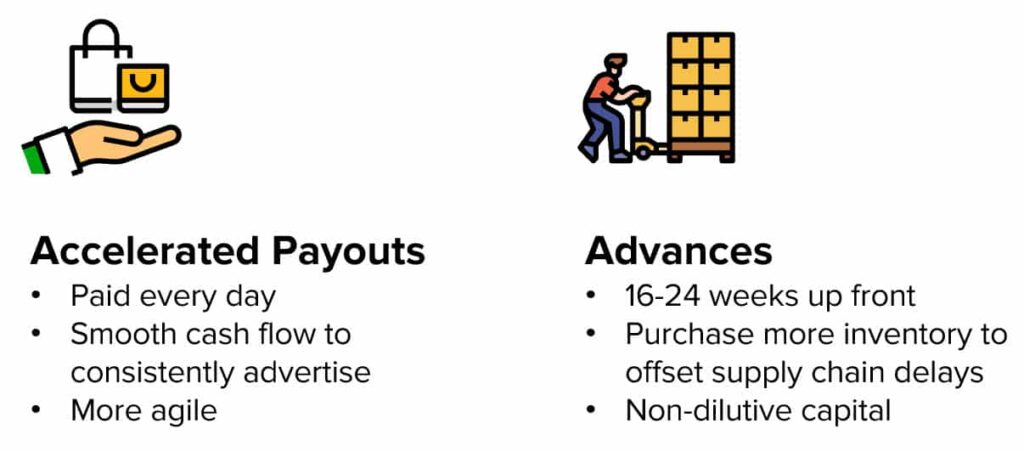

According to Jack, Payability sees sellers use their capital in three key ways: first, they use accelerated payouts to ensure that they never stop advertising. Second, they use advances to purchase more inventory up front, which eases the supply chain challenge and frees up working capital for other uses. Last, they’ll use extra capital to invest in technology, improving the foundation of their business.

A mix of capital advances and accelerated payouts will help your business keep pace with well-funded competition because it ensures that you’ll never be slowed down by cash flow issues. Getting paid daily instead of getting paid on Amazon’s bi-weekly schedule can often be the difference between keeping your ads running, or having to turn them off. Every hour that your ads are off, your competitors are gaining impressions, clicks, sales, and reviews – all of which bolster their long-term position in the buy box. If cash comes in steadily, you can send it out steadily as well, maintaining your competitiveness.

Advances ensure that you can take big swings at growing your business without jeopardizing your day-to-day operations. With the rat race of Amazon ads taking up such a big portion of a sellers’ cash flow, it can be difficult to pull together funds to make a big inventory purchase before a busy season, or to invest in a new software solution. Cash advances from purpose-built Amazon lenders can get you money much more quickly than traditional lending sources, and of course it’s a non-dilutive source of capital. With money in hand, you can invest in the upgrades you need to boost your competitiveness.

Perch’s Advice: What Aggregators Look For

Once you’ve secured a source of consistent Amazon lending on good terms, we’re sure that you’ll wonder: how can I best use the money?

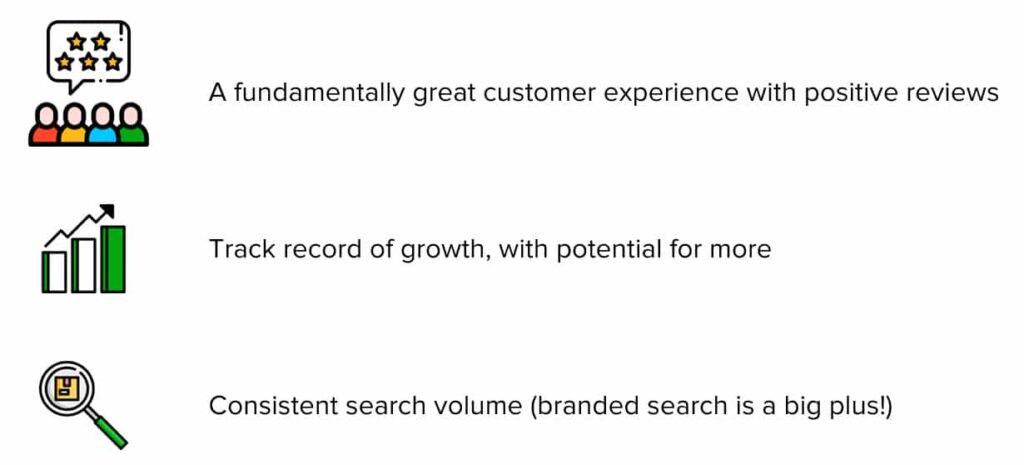

The rise of aggregators have significantly increased the competition that sellers face, but they also present an opportunity for a smooth exit and a life-changing payout. By learning what aggregators look for in a business, you can keep a target in mind. And because they overwhelmingly seek to buy businesses with strong fundamentals and potential to grow, adopting their techniques will likely improve your own results.

Nate Jackson, VP of Acquisitions at Perch, started out by covering some of the more obvious aspects of a well-run online store.

We’re sure that you’re already targeting these goals. You’re looking to provide a great customer experience with strong reviews. This will power a track record of growth, and even branded search.

What else should you know?

Nate let our audience in on a secret from the aggregator world – they don’t need to see products make money right away. When your competition launches a new product on Amazon, there’s a decent chance that they are prepared to accept 18 to 24 months of slim-to-no margins in order to establish it as a mature, winning cash cow. When products are in their ‘growth stage’, the seller will keep prices low to help it gain traction in the market, looking to gather positive reviews and a long track record at the top of the buy box. After 6 to 12 months of low prices, they’ll slowly start ratcheting up the price to expand their margin – but the product will stay high in the buy box thanks to its strong start. They look to have a product at “maturity” after an average of 18 months, at which point they’ll have it at its long-term target margins.

A reliable source of Amazon lending helps you fight back against competition that are “investing” in their products because it will ensure that you can keep up the competitive pressure. Accelerated payouts help you avoid dry spells in your cash flow, which can even enable you to drop your prices temporarily to build up your product. Without the outside funding help, you can’t cut your margins and survive periods of low cash flow.

Use Amazon Lending to Stay in Stock

We’ve all heard of the supply chain crisis – and we know that it’s going to take a long, long time to unwind. Many sellers unfortunately know the pain of waiting for new inventory as their existing stock dwindles, and wish that they had the capital to reorder earlier.

What else should you know?

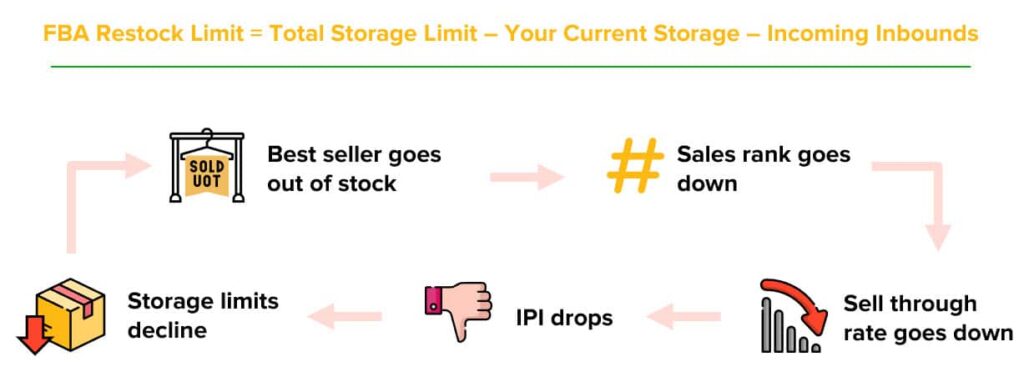

We can’t stress this enough – whatever you do, don’t go out of stock. Let’s say that you couldn’t scrape together enough cash to move up your inventory purchase, and as a result, your best seller went out of stock a week before Amazon received your new shipment. In the intervening week, you lost sales rank and your IPI score sank. That means that your inventory limits declined, making it more likely that you’ll go out of stock again. If it happens again, you’ll lose even more sales rank, and before you know it, your bankable best seller will see its volume halved.

Lenders that will advance money will help you avoid this trap. You can move up inventory purchases and ensure that you never go out of stock, protecting your hard-earned growth.

Build a Resilient Supply Chain

With increasing FBA fees , shrinking inventory limits , and receiving delays, FBA is no longer the all-in-one solution that it once was for Amazon sellers. We don’t think that FBA vs FBM is an either-or; to build a resilient supply chain, you should have both.

Your eCommerce order fulfillment strategy should take a page out of the experts’ books and use each service only for what it does best.

FBA offers a low-cost way to get a Prime badge on small and standard size products – but its prices aren’t good for large and up. It’s also a poor solution for launching new products, because inventory for new products will eat into inventory limits for best sellers, hurting your overall performance.

FBM via your own warehouse or a 3PL helps round out your approach. The best, most flexible 3PLs can also power Seller Fulfilled Prime and do FBA forwarding – so if you can find an all-in-one approach, you’ll only need one provider other than FBA. Going with an all-in-one solution saves headaches for you and helps you run lighter on inventory. You can then spend the extra money that you didn’t have to spend on inventory on ads, boosting your results.

Cahoot’s FBM fulfillment services will fuel your profitable growth on Amazon and unlock opportunity on all other eCommerce channels at the same time. Unlike most other 3PLs, we’ve built our network to the highest standard, so we enable affordable Seller Fulfilled Prime for many of our FBM clients.

If you’d like to find out how Cahoot can help your business, please get in touch with us. We can’t wait for you to join our community and boost your profitable growth.

Speakers

Manish Chowdhary, Founder & CEO, Cahoot

Cahoot is the world’s first peer-to-peer eCommerce order fulfillment network. Cahoot enables eCommerce merchants to increase sales with affordable nationwide 1-day and 2-day delivery – everywhere they sell. Manish is a 40 Under 40 Competition Winner and holds an Honorary Doctorate from the University of Bridgeport. And, this year, Cahoot was recognized as one of Fast Company’s World’s Most Innovative Companies.

Jack Howard, Head of Partnerships – Payability

Jack has over five years of Business Development and Partnerships experience at hyper-growth start-ups. Prior to joining the Payability team, Jack worked in Business Development at the real estate company SquareFoot, where he was instrumental in advising Private Equity and VC-backed companies on their real estate footprints in NYC. He holds dual degrees in Economics and Sport Management from Southern Methodist University in Dallas, Texas.

Nate Jackson, VP of Acquisitions, Perch:

Nate Jackson is the VP of Acquisitions at Perch, a technology-driven commerce company that acquires and operates top Amazon third-party and other D2C brands at scale. Prior to Perch, Nate was a Senior Manager at Bain & Company’s Private Equity Group. He received his MBA from Carnegie Mellon’s Tepper School of Business.