Warehouse KPIs: Measurement, Implementation, and Optimization

Warehouse Key Performance Indicators (KPIs) are essential metrics that drive operational excellence in logistics and supply chain management. These quantifiable measurements help warehouse managers track performance, identify inefficiencies, and make data-driven decisions to enhance productivity and profitability.

What Are KPIs and Their Value in Warehouse Management

Key Performance Indicators are specific, measurable values that demonstrate how effectively a company is achieving its business objectives. In warehouse operations, KPIs provide insights into operational efficiency, resource utilization, and overall performance.

The value of warehouse KPIs extends beyond simple measurement. They:

- Establish clear performance standards and expectations

- Identify operational bottlenecks and inefficiencies

- Facilitate data-driven decision making

- Enable continuous improvement processes

- Support budget justification and resource allocation

- Align warehouse operations with broader business goals

- Provide objective criteria for employee performance evaluation

KPIs transform reporting from a reactive to a proactive operation, where performance trends can be analyzed and addressed before they impact the bottom line.

How to Measure Warehouse KPIs

Effective KPI measurement requires a structured approach:

- Define Clear Objectives: Identify what you want to achieve in your warehouse operation. Objectives should align with overall business goals and be specific, measurable, achievable, relevant, and time-bound (SMART).

- Select Relevant KPIs: Choose metrics that directly relate to your defined objectives. Too many KPIs can dilute focus, so prioritize those most impactful to your operation.

- Establish Baselines: Measure current performance to establish a starting point against which future performance can be compared.

- Set Realistic Targets: Determine achievable performance targets based on historical data, industry benchmarks, and business requirements.

- Implement Measurement Systems: Deploy appropriate technologies and processes to collect accurate data, whether through warehouse management systems (WMS), barcode scanners, or manual tracking.

- Analyze Regularly: Review KPI data at consistent intervals to identify trends, anomalies, and improvement opportunities.

- Take Action: Implement changes based on KPI insights and track the impact of these changes on performance metrics.

- Refine and Adjust: Periodically reassess KPI relevance and modify your measurement approach as warehouse operations evolve.

Warehouse KPIs by Type

There are many different KPIs that can apply to warehousing. Here are several different types of KPIs, with some specific KPI examples and formulas to calculate them.

Understanding Inventory Management KPIs

Inventory management key performance indicators (KPIs) are critical metrics that provide warehouse and logistics managers with essential insights into the efficiency, accuracy, and financial performance of their inventory operations. These quantitative measurements serve as diagnostic tools that transform raw operational data into actionable intelligence, enabling businesses to optimize stock levels, reduce costs, improve customer satisfaction, and make data-driven strategic decisions. By tracking specific indicators across various stages of inventory management—from receiving and storage to order fulfillment—organizations can identify bottlenecks, minimize waste, and create more responsive and lean supply chain processes.

Inventory Management KPIs

KPI |

Purpose |

Formula |

Ideal Target |

|---|---|---|---|

Inventory Accuracy |

Measures precision of inventory record-keeping |

(Accurate Inventory Records ÷ Total Inventory Records) × 100% |

≥ 98% |

Inventory Turnover Rate |

Indicates how quickly inventory is sold and replaced |

Cost of Goods Sold ÷ Average Inventory Value |

4-6 times per year |

Days on Hand |

Average duration inventory is held before sale |

(Average Inventory Value ÷ Cost of Goods Sold) × Number of Days in Period |

Minimize while maintaining service levels |

Carrying Cost of Inventory |

Percentage cost of holding inventory |

(Storage Costs + Capital Costs + Inventory Service Costs + Inventory Risk Costs) ÷ Total Inventory Value |

15-30% of inventory value |

Receiving KPIs

KPI |

Purpose |

Formula |

Ideal Target |

|---|---|---|---|

Receiving Efficiency |

Measures units processed per labor hour |

Units Received ÷ Labor Hours Spent Receiving |

Maximize productivity |

Receiving Cycle Time |

Total time to process incoming shipments |

Time from Truck Arrival to Inventory Availability |

Minimize processing time |

Receiving Accuracy |

Percentage of orders received without errors |

(Correctly Received Orders ÷ Total Received Orders) × 100% |

≥ 99% |

Supplier On-Time Delivery |

Measures supplier delivery performance |

(On-Time Deliveries ÷ Total Deliveries) × 100% |

≥ 95% |

Putaway KPIs

KPI |

Purpose |

Formula |

Ideal Target |

|---|---|---|---|

Putaway Accuracy |

Percentage of items placed in correct locations |

(Correctly Located Items ÷ Total Items Put Away) × 100% |

≥ 99% |

Putaway Cycle Time |

Time to transport items to storage locations |

Average Time from Receiving to Storage |

Minimize processing time |

Putaway Cost per Unit |

Average cost to place one unit in storage |

Total Putaway Costs ÷ Number of Units Put Away |

Minimize cost |

Order Management KPIs

KPI |

Purpose |

Formula |

Ideal Target |

|---|---|---|---|

Order Picking Accuracy |

Percentage of orders picked without errors |

(Correctly Picked Orders ÷ Total Orders Picked) × 100% |

≥ 99.5% |

Order Picking Productivity |

Measures workforce picking efficiency |

Units Picked ÷ Labor Hours Spent Picking |

Maximize productivity |

Perfect Order Rate |

Comprehensive performance metric |

(Orders Delivered Complete, Accurate, On-Time, and Undamaged ÷ Total Orders) × 100% |

≥ 95% |

Order Cycle Time |

Total order processing time |

Average Time from Order Receipt to Shipment |

Minimize processing time |

Fill Rate |

Percentage of order items fulfilled on first shipment |

(Number of Items Shipped ÷ Number of Items Ordered) × 100% |

≥ 95% |

Safety KPIs

KPI |

Purpose |

Formula |

Ideal Target |

|---|---|---|---|

Incident Rate |

Safety incidents per 100 employee-years |

(Number of Recordable Incidents × 200,000) ÷ Total Hours Worked |

Minimize |

Lost Time Injury Frequency Rate |

Injuries resulting in lost work time |

(Number of Lost Time Injuries × 1,000,000) ÷ Total Hours Worked |

Zero incidents |

Safety Training Compliance |

Percentage of employees with current safety training |

(Employees with Up-to-Date Safety Training ÷ Total Employees) × 100% |

100% |

Near Miss Reporting |

Potential incidents without injury or damage |

Number of Near Misses Reported |

Encourage reporting |

Challenges in Using Warehouse KPIs

Implementing key performance indicators (KPIs) in warehouse management can significantly impact operational effectiveness. Data quality emerges as a critical first hurdle, as the accuracy and completeness of performance metrics fundamentally depend on reliable information collection. Inaccurate or incomplete data can lead to misleading KPI values, causing management to make strategic decisions based on flawed insights. For instance, a warehouse might appear to be performing efficiently according to its metrics, when in reality, underlying data collection issues are masking critical operational inefficiencies.

The risk of over-measurement further complicates KPI implementation, creating a potential scenario of information paralysis. When organizations attempt to track an excessive number of metrics, they inadvertently dilute their focus and create unnecessary complexity in performance management. This approach can overwhelm warehouse managers and staff, making it difficult to concentrate on the most critical performance indicators that truly drive operational excellence. The key lies in strategic selection; choosing a focused set of KPIs that provide meaningful insights without causing cognitive overload or distracting from core operational objectives.

Organizational dynamics introduce another layer of complexity in KPI management, particularly through misaligned incentives and potential employee resistance. Performance metrics can sometimes create unintended consequences by encouraging behaviors that might optimize one aspect of performance while undermining another. For example, a KPI emphasizing order processing speed might inadvertently compromise order accuracy, or metrics rewarding individual productivity could potentially discourage collaborative teamwork. Moreover, employees may perceive performance measurement as a threatening surveillance mechanism rather than a tool for continuous improvement, leading to potential resistance and reduced engagement.

The financial and operational investment required for sophisticated KPI implementation presents a significant challenge for many warehouses. Establishing robust measurement systems demands substantial investments in technology infrastructure, data collection tools, and comprehensive staff training programs. These costs can be particularly prohibitive for smaller organizations with limited resources. Additionally, KPIs are not static constructs but dynamic tools that require continuous refinement. Context sensitivity demands periodic reassessment and adjustment of metrics to account for seasonal variations, evolving business strategies, technological advancements, and changing market conditions. Successful KPI implementation thus requires not just initial investment, but ongoing commitment to adaptability, technological integration, and organizational learning.

Tools for Measuring KPIs

Modern warehouse operations utilize various tools to measure and track KPIs:

- Warehouse Management Systems (WMS): Comprehensive software solutions that manage inventory, track orders, and generate KPI reports.

- Enterprise Resource Planning (ERP) Systems: Integrate warehouse data with broader business metrics for holistic performance measurement.

- Business Intelligence (BI) Platforms: Transform raw data into actionable insights through visualization and analytical capabilities.

- IoT Sensors and RFID: Provide real-time tracking of inventory movement and equipment utilization.

- Barcode and QR Code Systems: Enable accurate data capture for inventory and order processing.

- Labor Management Systems (LMS): Track individual and team productivity metrics.

- Data Dashboards: Present KPI information visually for quick decision-making.

Advanced Strategies and Tips for Using KPIs

Once KPIs are established, there are additional ways to leverage KPIs. First, predictive analytics leverage historical KPI data to forecast future performance trends and proactively address potential issues. Implement systems that provide immediate feedback on critical KPIs, allowing for rapid response to developing issues.

Remember that not all KPIs carry the same weight; ensure KPIs address multiple perspectives: financial, customer, internal processes, and learning/growth and implement tiered KPI structures where high-level metrics cascade down to operational-level indicators, creating alignment across the organization.

Finally, make KPIs collaborative; involve warehouse staff in KPI development to increase buy-in and ensure metrics are practical and relevant. Use friendly competition and recognition to drive KPI improvement among warehouse teams.

KPIs vs. Benchmarks

KPIs and benchmarks serve complementary purposes in warehouse management. KPI’s measure the business performance internally against itself, while benchmarks compare business performance to industry best practices.

Effective warehouse management requires both internal KPIs for operational control and external benchmarks for strategic positioning. While KPIs track progress toward specific operational goals, benchmarks provide context for how your performance compares to industry standards, helping identify competitive advantages or improvement opportunities.

When using benchmarks, consider industry segment, warehouse size, product type, and geographical location to ensure relevant comparisons. Sources for benchmark data include industry associations, consulting firms, and supply chain research organizations.

Conclusion

In conclusion, warehouse KPIs provide the quantitative foundation for data-driven management, operational excellence, and continuous improvement. When properly selected, measured, and analyzed, these metrics transform warehouse operations from cost centers to strategic assets that contribute significantly to organizational success.

Frequently Asked Questions

How do I Track Warehouse KPIs?

Each KPI has their own metric or formula. For example, inventory accuracy is measured by

Number of Errors / Total Inventory x 100%.

What are the Most Important Warehouse KPIs to Track?

There are many KPIs, and just tacking on KPIs doesn’t help. In general, Accuracy and Cost related KPIs are always helpful.

What is the Best Way to Monitor Warehouse KPIs?

Use Warehouse Management Systems (WMS) or Inventory Management Software to automatically track and analyze KPIs.

How Often Should I Review Warehouse KPIs?

KPIs should be reviewed weekly or monthly; KPIs should be used to correct and adjust before problems become major issues.

Up to 64% Lower Returns Processing Cost

Understanding Dimensional Weight Pricing

As ecommerce continues to grow year-over-year, shipping costs remain one of the most critical elements affecting profitability. Dimensional weight pricing, often abbreviated as dim weight, is a crucial concept that every ecommerce business must grasp to avoid overpaying for shipping. This pricing model is designed to account for the space that a package occupies in relation to its actual weight. Whether you are a small business owner or managing logistics for a large ecommerce operation, understanding how dimensional weight works can help streamline your shipping processes and save on costs. In this article, we will break down what dimensional weight is, why carriers use it, and how to manage and minimize its impact on shipping expenses.

What is Dimensional Weight?

Dimensional weight is a pricing technique used by shipping carriers to charge based on the volume of a package rather than its actual weight. In traditional weight-based shipping models, customers pay according to the physical weight of their package. However, this approach doesn’t always account for packages that are large but lightweight—think of a large box filled with foam padding or bubble wrap, but containing only a small item inside. In these cases, the carrier is still using valuable space on their truck or aircraft, and thus, dimensional weight is applied.

To calculate dimensional weight, the carrier will use a formula that considers the dimensions of the package—its length, width, and height. For most carriers, this is usually done by multiplying these three dimensions together to find the volume of the package. That number is then divided by a standard “dimensional factor,” which varies depending on the carrier.

For example, if a box measures 12 inches long, 10 inches wide, and 8 inches tall, the volume would be 960 cubic inches (12 x 10 x 8). The carrier would then divide that number by the dimensional factor (let’s say it’s 139 for domestic ground shipping with FedEx or UPS), which results in a dim weight of 6.9 pounds (rounded up to the nearest pound, so 7 pounds). If the actual weight of the package is 3 pounds, the carrier would charge for the 7-pound dimensional weight instead of the actual weight, since it takes up more space.

Why Do Carriers Use Dimensional Weight?

Carriers adopted dimensional weight pricing to more accurately reflect the costs of transporting packages. Shipping is not only about the weight of the package—it’s also about how much space it occupies in a truck or airplane. The more space a package takes up, the less room there is for other packages. For shipping carriers, this means they can carry fewer goods, which ultimately reduces their efficiency and increases costs.

In recent years, the rise of ecommerce has led to an influx of smaller, lightweight items that are packaged in oversized boxes. While these packages are light in weight, they take up considerable space in transportation vehicles. As a result, carriers needed a way to ensure they were being fairly compensated for the space they were losing in favor of these packages. Dimensional weight provides a more accurate measure of the space a package occupies, which helps carriers balance costs, maximize capacity, and avoid inefficiencies.

Additionally, with the increasing popularity of express shipping and global commerce, international shipping has become more complex. In the case of air freight, the cost of moving goods is heavily influenced by the weight-to-space ratio. Shipping carriers must account for both weight and volume when determining prices to remain competitive while covering their expenses. Dimensional weight ensures that carriers are not subsidizing the cost of lighter, bulkier packages, which is crucial for maintaining profitability in a highly competitive and resource-intensive industry.

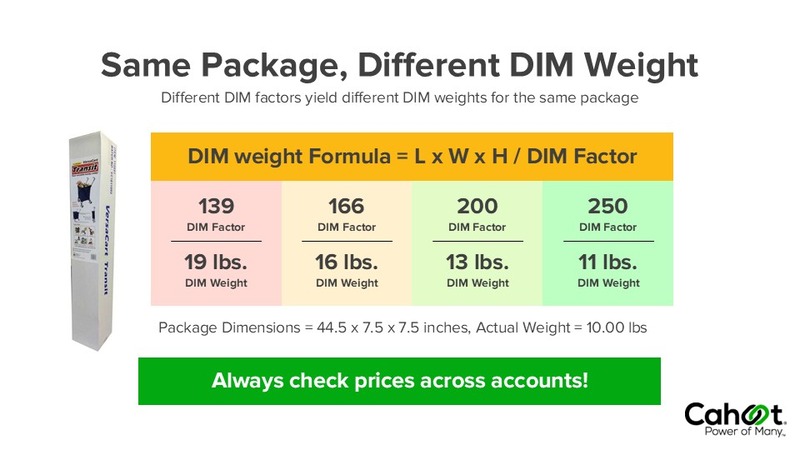

The Importance of the DIM Factor

The “DIM factor” is a crucial element in dimensional weight pricing. This factor represents the “expected” ratio of a package’s volume (in cubic inches) to its weight. It plays a vital role in determining the dimensional weight of a package, and its value can vary depending on the carrier and the mode of transportation (ground, air, etc.). The DIM factor is a multiplier that converts the volume of the package into a weight equivalent. A lower DIM factor means that less volume per pound is “expected,” resulting in a higher dimensional weight, while a higher DIM factor leads to a lower dimensional weight for the same package.

Understanding the DIM factor is essential for ecommerce shippers because it allows them to better estimate shipping costs. As indicated above, different carriers may use different DIM factors, and knowing these differences can help make more informed decisions about which carrier to choose for a specific shipment. Additionally, some carriers may update their DIM factors periodically, so it’s important to stay informed about any changes to ensure you’re not caught off guard by unexpected cost increases.

Carriers can offer different DIM factors depending on the type of shipment. For example, express and international shipments might have a different DIM factor compared to standard ground shipping. This variation in the DIM factor means that dimensional weight can affect the total cost of shipping depending on how quickly the package needs to reach its destination and the method of transport being used.

Differences in DIM Factors Among Carriers and 3PLs

Different shipping carriers use slightly varied dimensional weight (DIM) calculation methods, primarily by adjusting the DIM factor, which influences how volume converts to weight. For example:

- FedEx, DHL, and UPS generally use a DIM factor of 139 for ground shipments within the U.S.

- USPS uses a factor of 166.

Additionally, different DIM factors may be used for air as opposed to ground shipments. This means that the same package might be billed at different rates depending on which carrier is used, making it crucial for shippers to compare options before selecting a service.

Some carriers also offer customized DIM factors for high-volume shippers or businesses that negotiate specific contracts. Additionally, certain services, such as USPS Priority Mail, do not apply dimensional weight pricing unless the package exceeds a particular size threshold (e.g., one cubic foot for domestic shipments). Understanding these variations can help ecommerce businesses strategically choose carriers and optimize packaging to minimize shipping costs.

In addition to differences in DIM factors among carriers, various 3PL services may use differing DIM factors when assessing fulfillment or inventory removal fees. Just as carriers use different DIM factors when calculating rates for different kinds of shipments, 3PLs may use different factors for domestic as opposed to international shipments, or for specific product classes. Be sure to confirm the DIM factors used by any 3PL service, including FBA, to accurately forecast shipping and fulfillment costs.

How to Minimize Dimensional Weight Costs

While dimensional weight pricing is a reality that ecommerce shippers must navigate, there are several strategies that can help minimize the associated costs. Here are some practical tips for reducing the financial impact of dimensional weight:

- Optimize Packaging: One of the most effective ways to reduce dimensional weight charges is to carefully consider the packaging you use. Shipping products in unnecessarily large boxes is a common mistake that results in higher shipping costs. Choose packaging that fits the product as closely as possible without wasting space. Nowadays, there is cartonization software that helps you decide what package to use to minimize excess space. If you can’t, you may also want to explore packaging materials like air pillows or foam inserts that can better protect your products while minimizing wasted space.

- Use Custom Packaging: If you consistently ship products that have irregular shapes or sizes, investing in custom packaging could be a smart move. Custom packaging allows you to reduce empty space within the box, which will help lower the dimensional weight.

- Consolidate Shipments: For businesses that ship multiple items, consolidating shipments into fewer packages can help lower dimensional weight charges. Instead of sending each item individually, combine them into a larger, more efficient package. This strategy helps spread out the dimensional weight across multiple products, reducing the overall cost of shipping.

- Take Advantage of Volumetric Pricing: Some carriers offer volume discounts or reduced dimensional weight charges for larger or heavier shipments. If you regularly ship large volumes, consider negotiating with carriers for better rates based on your shipment sizes. Shipping in bulk or negotiating long-term contracts with carriers can also provide discounts on dimensional weight charges.

- Compare Carrier Rates: As we’ve discussed, the DIM factor used can vary between carriers or between services for a given carrier. The exact same package can be billed as 18 pounds in one carrier account and 35 pounds in another. Therefore, it’s important to compare rates from different carriers to see who offers the most cost-effective pricing based on your packages’ size and weight.

- Monitor Your Shipments: Consistently tracking your shipping costs and reviewing your packaging practices can lead to ongoing savings. If you notice that certain shipments are disproportionately affected by dimensional weight pricing, reassess your packaging and look for ways to reduce the dimensions of those shipments.

- Choose the Right Service: When selecting a shipping method, choose the one that best fits the size and weight of your package. Ground shipping, for example, often has different dimensional weight rules than air freight, and express services can come with higher fees due to the faster delivery time. Take time to analyze your options before committing to a particular service.

Conclusion

Dimensional weight pricing is a necessary part of modern shipping, particularly for ecommerce businesses that regularly ship lightweight but bulky packages. Understanding dimensional weight, the importance of the DIM factor, and how to minimize costs can significantly improve your bottom line. By optimizing packaging, choosing the right carrier, and staying informed about changes in pricing, you can effectively navigate dimensional weight charges and keep your shipping expenses in check. In the competitive world of ecommerce, small adjustments to your shipping strategy can lead to big savings, ultimately helping you offer more competitive pricing and enhancing your customers’ satisfaction.

Fortunately, Cahoot is here to help. Our state-of-the-art shipping software is able to integrate across all major sales channels and compares rates across carriers to automatically select the most cost-effective options to meet your delivery requirements. Our nationwide network of warehouses ensures that, whatever your product and wherever your customer base, we are able to accommodate your specific fulfillment needs. Our proven solutions can help small businesses scale into established players, provide needed savings to sellers seeking to remain competitive, or find the best shipping solutions for bulky or hard-to-ship products. Whatever blockers are keeping your business from reaching its potential, Cahoot is here to help.

Frequently Asked Questions

Why is dimensional weight used by carriers?

Dimensional weight is used to account for the space taken up by a package as well as its weight. This kind of pricing has long been used for services like air freight, where space is at a premium and must be accounted for. With the explosion of ecommerce in the late 2000s and early 2010s, the major carriers began to apply dimensional weight pricing to ground shipments around 2015, to ensure that limited space in freight and delivery trucks is used efficiently.

Why do DIM factors differ between carriers or services?

Different carriers use varying DIM factors to align their pricing models with their specific operational costs, transportation methods, and target markets. The DIM factor represents the volume that equates to one pound of billable weight, and adjusting the factor allows carriers to balance space utilization and profitability. A lower DIM factor results in a higher dimensional weight, meaning shippers are charged more for bulky but lightweight packages. Conversely, a higher DIM factor allows for more generous volume-to-weight conversions, reducing costs for shippers.

Up to 64% Lower Returns Processing Cost

Understanding the Relationship of 3PLs and Dropship Services

In this article

17 minutes

17 minutes

- Understanding 3PL (Third-Party Logistics)

- Advantages of 3PLs

- Disadvantages of 3PLs

- Understanding Dropshipping

- Advantages of Dropshipping

- Disadvantages of Dropshipping

- Key Differences Between 3PL and Dropshipping

- How Dropshipping and 3PLs Interact

- Full Service Automation Integrations (Dynamic Fulfillment)

- Challenges of Managing Inventory in Dropshipping

- Future Outlook

- Conclusion

- Frequently Asked Questions

In today’s rapidly evolving ecommerce landscape, entrepreneurs are constantly seeking efficient ways to manage inventory, fulfill orders, and scale their businesses. Two popular models that frequently intersect are third-party logistics (3PL) and dropshipping. While these terms are sometimes used interchangeably, they represent distinct approaches to supply chain management, each with unique advantages and considerations.

Understanding 3PL (Third-Party Logistics)

What is 3PL?

A third-party logistics provider (3PL) is a company that offers outsourced logistics services, including fulfillment services, handling various aspects of the supply chain on behalf of another business. 3PL providers essentially function as extensions of a business’s operations, taking over the physical aspects of inventory management and order fulfillment while the business focuses on product development, marketing, and customer relationships.

How 3PLs Work

The typical 3PL relationship begins when a business sends its inventory to the 3PL’s warehouse facilities. The 3PL then:

- Receives and catalogs inventory

- Stores products in organized warehouse spaces

- Integrates with the business’s ecommerce platform

- Processes incoming orders automatically

- Picks, packs, and ships orders to end customers

- Provides tracking information and delivery updates

- Handles returns and exchanges as needed, ensuring efficient order fulfillment throughout the entire process

Advantages of 3PLs

Using a 3PL provider can bring numerous benefits to a business, including:

- Expertise and Infrastructure: 3PLs offer specialized logistics knowledge and advanced infrastructure (warehouse systems, equipment) that would be costly for businesses to develop independently.

- Scalability: Businesses can rapidly scale operations during peak periods (handling 5-10x normal volume) without investing in additional resources, and avoid excess capacity costs during slower periods.

- Focus on Core Competencies: By outsourcing logistics, businesses can redirect energy toward strategic activities like product innovation, marketing, and customer relationships.

- Geographic Expansion: 3PLs with networks of fulfillment centers enable businesses to reduce shipping times and costs, offer competitive delivery options, and expand internationally with minimal risk.

- Cost Efficiency: 3PLs negotiate lower shipping rates (25-50% less), convert fixed costs to variable expenses, and can reduce total fulfillment costs by 15-30% compared to in-house operations.

Disadvantages of 3PLs

3PL providers also have disadvantages:

- Loss of Control: Businesses surrender direct oversight of fulfillment operations, creating accountability challenges when problems arise and limiting ability to make real-time adjustments.

- Setup Costs and Minimums: Initial onboarding fees ($500-$5,000) and monthly minimums ($500-$2,000) create financial barriers, especially for startups or businesses with fewer than 100-200 monthly orders.

- Integration Challenges: Connecting ecommerce platforms with 3PL systems can be technically complex, requiring substantial development work and ongoing maintenance.

- Reduced Branding Opportunities: Standard 3PL procedures prioritize efficiency over customization, limiting opportunities for distinctive packaging and unboxing experiences.

- Additional Fees: Ancillary charges for long-term storage, special handling, returns processing, and other services can increase fulfillment costs by 20-40% above base rates.

Understanding Dropshipping

What is Dropshipping?

Dropshipping is a retail fulfillment model where online stores don’t keep products in stock. Instead, when a customer places an order, the store purchases the item from a third party (usually a manufacturer or wholesaler) who ships the product directly to the customer. The seller never handles the product physically but acts as a middleman between supplier and customer. Dropshipping fulfillment services play a crucial role in this model by partnering with third-party logistics providers (3PLs) to manage order fulfillment, scale operations, and enhance customer experience.

How Dropshipping Works

- A customer places an order on the seller’s ecommerce store

- The seller automatically or manually forwards the order details to the supplier

- The supplier processes the order, packages the product, and ships it directly to the customer

- The seller keeps the margin between their retail price and the supplier’s wholesale price

Advantages of Dropshipping

Low Startup Costs

Dropshipping fundamentally transforms the economics of launching an ecommerce business by virtually eliminating upfront inventory investment. Traditional retail models typically require $10,000-$100,000+ in initial inventory purchases before selling a single product, creating significant financial barriers to entry. With dropshipping, entrepreneurs can establish fully operational online stores with investments as low as $100-$500, primarily covering website hosting, ecommerce platform subscriptions, and basic marketing expenses.

Reduced Overhead

The operational simplicity of dropshipping eliminates numerous fixed costs that typically burden traditional ecommerce businesses. Without physical inventory, entrepreneurs avoid warehouse leases ($2,000-$10,000+ monthly depending on location and size), utilities, insurance, security systems, and maintenance expenses. The absence of inventory handling eliminates the need for forklifts, shelving systems, packaging stations, and other warehouse equipment—investments that typically cost $25,000-$100,000 for even modest operations.

Perhaps most significantly, dropshipping businesses avoid the substantial personnel costs associated with traditional fulfillment: no warehouse managers ($50,000-$80,000 annually), pickers and packers ($15-$20/hour), receiving staff, or inventory control specialists.

Location Independence

Dropshipping liberates entrepreneurs from geographic constraints. Since the business operates entirely through digital interfaces; ecommerce platforms, supplier portals, marketing tools, and communication systems, owners can manage operations from anywhere with reliable internet connectivity.

This location independence enables diverse business scenarios impossible in traditional retail: digital nomads running seven-figure stores while traveling continuously, entrepreneurs accessing global markets from rural areas with limited local opportunities, expatriates building businesses serving their home countries while living abroad, or parents operating substantial enterprises around family responsibilities from home offices.

Wide Product Selection

Dropshipping fundamentally transforms inventory economics, enabling businesses to offer expansive product catalogs that would be financially impossible under traditional inventory models. While conventional retailers might stock 500-2,000 SKUs based on capital constraints and warehouse space, dropshipping stores routinely offer 10,000+ products without incremental investment or operational complexity.

This catalog flexibility creates multiple strategic advantages: the ability to function as comprehensive category destinations rather than specialized boutiques, opportunities to capture long-tail search traffic across thousands of specific product queries, and the capacity to rapidly adapt to emerging trends without inventory liquidation concerns. The breadth of selection enables sophisticated merchandising strategies like “good-better-best” pricing tiers, complementary product ecosystems, and comprehensive solution selling across related categories.

Easy to Test Products

The ability to rapidly test new products with minimal financial risk represents one of dropshipping’s most powerful strategic advantages, enabling an iterative, data-driven approach to product selection impossible in traditional retail.

With conventional inventory models, adding a new product typically requires committing to minimum order quantities (often 100+ units), investing $500-$5,000 before knowing if the item will resonate with customers.

Dropshipping transforms this equation—entrepreneurs can add dozens or hundreds of products to their stores in days, investing only the time required for product research and listing creation.

Disadvantages of Dropshipping

Lower Profit Margins

While traditional retailers typically achieve 50-80% gross margins through direct manufacturer relationships and volume purchasing, dropshipping businesses generally operate with 15-30% margins due to working through intermediaries who capture significant value in the supply chain.

This margin pressure intensifies in highly visible product categories where price competition is transparent and fierce. The competitive landscape exacerbates these challenges—the low barriers to entry create saturated markets where numerous sellers offer identical products, frequently triggering price wars that further erode margins.

Expensive Shipping

Unlike traditional ecommerce where orders are fulfilled from a single warehouse, dropshipping frequently involves multiple suppliers shipping independently to the same customer. When customers purchase multiple products in a single order that source from different suppliers, they receive multiple shipments — a three-item order from three suppliers typically generates shipping charges 200-300% higher than consolidated fulfillment, substantially eroding profitability or forcing difficult decisions about shipping subsidies.

Inventory Issues

The absence of direct inventory control creates persistent operational vulnerabilities for dropshipping businesses, particularly regarding stock availability and accuracy. Unlike traditional retail where inventory is physically on-hand and continuously monitored, dropshippers rely entirely on supplier inventory systems that vary dramatically in sophistication and reliability. Inventory data typically refreshes only periodically (every few hours or daily), creating windows where items showing as available may actually be depleted.

This inventory opacity produces the dropshipping model’s most dreaded scenario: processing customer orders for products that prove to be unavailable, necessitating cancellations, backorders, or substitutions that damage customer trust and generate negative reviews.

Quality Control Challenges

The inability to physically inspect products before they reach customers creates fundamental quality assurance challenges unique to the dropshipping model. Traditional retailers implement multiple quality checkpoints; receiving inspections, periodic inventory audits, and final verification during picking, to ensure customers receive merchandise matching expected specifications and in good condition.

Dropshippers, however, rely entirely on suppliers’ quality processes, effectively outsourcing this critical aspect of customer experience with limited oversight capability. This quality control gap manifests in several problematic scenarios: products arriving with manufacturing defects that would have been caught in standard inspections, packaging damage during extended storage at supplier facilities, outdated or previous-generation products shipped without notification, and incorrect items due to supplier picking errors.

Supplier Dependency

The extreme reliance on suppliers as operational partners rather than merely product sources creates unique vulnerability for dropshipping businesses compared to inventory-based models. Traditional retailers maintain buffer inventory that insulates them from temporary supplier disruptions and provides negotiating leverage. Dropshippers, however, connect customer expectations directly to supplier performance without intermediary control points, creating existential dependency.

This dependency manifests across multiple business dimensions: any supplier fulfillment delay instantly becomes the dropshipper’s customer service problem, supplier stock maintenance directly determines product availability, supplier shipping methods define delivery timeframes, and supplier packaging represents the customer’s unboxing experience.

The relationship asymmetry often creates challenging power dynamics—suppliers typically prioritize their direct B2C operations and large wholesale accounts over dropshipping partners, creating service disparities during capacity constraints.

Key Differences Between 3PL and Dropshipping

Dropshipping: No Inventory Costs

The financial model of dropshipping centers on eliminating upfront inventory investment, creating a distinctive cash flow profile and cost structure. This capital efficiency extends throughout the business lifecycle, as product catalog expansions require no additional investment beyond digital assets and marketing. The tradeoff for this capital efficiency comes in unit economics—dropshipped products typically cost 30-50% more than equivalent items purchased in wholesale quantities, significantly compressing gross margins.

The 3PL fulfillment model creates a hybrid cost structure combining significant upfront inventory investment with professional fulfillment economics. Businesses must first purchase inventory at wholesale; this inventory ownership creates working capital requirements, carrying costs, and obsolescence risks absent in dropshipping, but enables wholesale pricing typically 30-50% lower than dropshipping sources.

3PLs allow Order Fulfillment Customization

Unlike inventory models where businesses control each fulfillment step, dropshippers must accept suppliers’ existing quality standards, packaging approaches, and shipping methods with minimal customization opportunity.

The 3PL fulfillment model creates a structured framework where businesses maintain significant control over critical customer experience elements while outsourcing operational execution.

3PL relationships operate as directed partnerships where the business establishes specifications, standards, and protocols executed by the 3PL. Businesses specify packaging materials, inserts, and presentation elements the 3PL implements.

Scalability

The dropshipping model offers unparalleled product catalog scalability while introducing distinctive operational scaling challenges as order volume increases. The model’s most significant scaling advantage lies in inventory breadth; businesses can expand from dozens to thousands of products without additional capital investment or operational complexity.

The 3PL model creates a structured framework for predictable operational scaling while requiring proportional capital investment to support growth.

Professional 3PLs maintain excess capacity designed to accommodate client growth and seasonal fluctuations, with sophisticated warehouse management systems, staffing models, and physical infrastructure capable of handling 5-10x volume increases during peak periods.

How Dropshipping and 3PLs Interact

3PL Warehouse for Dropshipping (Hybrid Inventory Model)

This hybrid approach balances owned inventory with dropshipped products to optimize both customer experience and business operations. Implementation typically begins with inventory segmentation analysis, where businesses analyze sales data to identify the top 20% of products that generate 80% of revenue (following the Pareto principle). Companies then employ demand forecasting techniques, using historical data and seasonality trends to predict which products should be stocked versus dropshipped. To manage this dual approach effectively, businesses implement specialized inventory management software such as Skubana, Linnworks, or InventorySource that can track both owned and dropshipped inventory in a unified dashboard. Many also set up automatic reordering systems, establishing par levels for 3PL-stored items with automatic purchase orders triggered when inventory reaches predetermined threshold levels.

The benefits of this hybrid model are substantial and multifaceted. Reduced stockouts ensure core products are always available for immediate shipment, while better cash flow management keeps capital tied up only in proven sellers. Customer satisfaction improves with faster delivery for the most common purchases. The approach also provides excellent risk mitigation, as new product lines can be tested via dropshipping before committing to inventory purchase. Seasonal flexibility allows businesses to expand offerings during peak seasons without warehouse expansion.

As a real-world example, a home goods retailer might stock their bestselling bedding collections with a 3PL while dropshipping decorative accessories, seasonal items, and furniture. This strategy allows them to ship core products quickly while offering an extensive catalog without the associated inventory costs.

Shipping 3PL for Dropshipping (2-Step Dropshipping)

This model creates a buffer between suppliers and customers, addressing many traditional dropshipping challenges. The process flow begins when a customer places an order on the merchant’s website. The order is then sent to the dropship supplier, who ships products to the merchant’s 3PL facility rather than directly to the customer. The 3PL receives, processes, repackages, and ships to the end customer, creating a more controlled fulfillment experience.

The infrastructure requirements for this approach include cross-docking facilities with dedicated areas within the 3PL warehouse for quickly processing incoming dropship orders. Quality control protocols establish standardized inspection procedures for all incoming dropshipped products. Custom packaging materials such as branded boxes, inserts, and marketing materials are stored at the 3PL. An order management system provides the software backbone that can track items from multiple suppliers through the consolidation process.

Additional advantages of this model include quality assurance, offering the opportunity to inspect products before they reach customers. Value-added services become possible, including personalization, gift wrapping, or custom inserts. Returns management is centralized, with potential for restocking suitable items. Shipping carrier optimization allows 3PLs to choose the most cost-effective shipping method for each package. Multi-channel fulfillment enables orders from various sales channels to be consolidated and fulfilled consistently.

Cost considerations should not be overlooked, as this approach typically incurs higher operational costs than direct dropshipping. These include an additional shipping leg from supplier to 3PL, 3PL handling and processing fees, potential storage fees for items awaiting consolidation, and often minimum monthly order volume requirements to be cost-effective.

Full Service Automation Integrations (Dynamic Fulfillment)

This sophisticated approach creates a unified ecosystem where fulfillment decisions are automated and optimized. Technical components include API-based integrations providing direct connections between ecommerce platforms, supplier networks, 3PL systems, and shipping carriers. Decision logic engines contain algorithms that determine the optimal fulfillment path based on multiple variables. Real-time inventory visibility offers live inventory feeds from both owned warehouse stock and dropship supplier availability. Shipping time calculators estimate delivery dates based on fulfillment method, carrier options, and destination. Middleware solutions such as Convictional, Fabric, or ChannelApe facilitate communication between disparate systems.

The advanced capabilities of this approach are significant. Split order fulfillment automatically divides orders for optimal processing, with some items coming from 3PL and others dropshipped. Geographic routing sends orders to the fulfillment option closest to the end customer. Margin-based routing chooses fulfillment methods that preserve profitability on each order. Dynamic supplier selection automatically chooses between multiple dropship suppliers based on availability, price, and performance. Predictive stocking uses AI to identify which dropshipped items should be converted to stocked inventory.

Challenges and considerations for this model include system complexity, which requires a sophisticated technology stack and often custom development work. Integration maintenance demands ongoing technical resources to maintain connections as platforms evolve. Exception handling processes must be established for managing orders when automated decisions encounter problems. Data synchronization ensures consistent information across all platforms in near real-time. Training requirements mean staff need understanding of complex systems and troubleshooting capabilities.

The implementation timeline typically requires 6-12 months for full deployment. Many businesses implement in phases, starting with core integrations and gradually expanding functionality. Extensive testing is necessary before full deployment to ensure all systems work seamlessly together and can handle various edge cases and exceptions.

Challenges of Managing Inventory in Dropshipping

Inventory management is a critical component of any dropshipping business, directly impacting customer satisfaction and profitability. However, managing inventory in a dropshipping model presents unique challenges. Unlike traditional retail, where businesses hold their own stock, dropshipping relies on third-party suppliers to maintain inventory levels.

- Stockouts: Running out of stock can lead to lost sales and disappointed customers. Without direct control over inventory, dropshipping businesses must rely on suppliers to keep stock levels updated, which can be unpredictable.

- Inventory Tracking: Keeping track of inventory levels across multiple suppliers can be complex. Accurate inventory tracking is essential to avoid stockouts and overstocking, but it can be challenging without the right systems in place.

- Supplier Management: Managing relationships with multiple suppliers can be difficult, especially when dealing with different lead times, shipping costs, and quality standards. Effective supplier management is crucial to ensure a reliable supply chain.

By outsourcing inventory management to a 3PL provider, dropshipping businesses can overcome these challenges. A 3PL provider can handle tasks such as inventory tracking, supplier management, and order fulfillment, ensuring that products are delivered to customers quickly and efficiently. This not only improves customer satisfaction but also enhances the overall efficiency and profitability of the dropshipping business.

Future Outlook

The next few years will likely see the emergence of hyperlocal fulfillment networks revolutionizing delivery expectations. These ultra-fast delivery systems will operate at the neighborhood level through micro-fulfillment centers, bringing products even closer to consumers and enabling delivery windows measured in hours rather than days.

Sustainability-driven distribution is rapidly transitioning from a marketing advantage to a competitive necessity. As consumers increasingly factor environmental impact into purchasing decisions, carbon-neutral fulfillment options will become standard offerings.

Automated decision optimization represents another major shift, with AI systems increasingly handling complex fulfillment decisions without human intervention. These sophisticated systems will analyze thousands of variables simultaneously—including inventory positions, carrier capacity, weather patterns, and customer preferences—to make optimal routing and fulfillment decisions in milliseconds.

The shopping experience itself will transform through AR/VR enhanced customer experiences, allowing virtual product interaction before purchase decisions. These technologies will bridge the gap between online convenience and in-store tactile experiences, reducing return rates by setting accurate expectations and increasing conversion rates by building purchase confidence.

These evolving models represent the cutting edge of ecommerce operations, blending the flexibility of dropshipping with the control and reliability of 3PL fulfillment to create resilient, scalable businesses that can compete effectively in today’s demanding market.

Conclusion

Both 3PL and dropshipping offer valuable approaches to ecommerce fulfillment, each with distinct advantages and challenges. While dropshipping provides a low-risk entry point for new entrepreneurs, 3PL services offer more control and potentially better economics at scale. Increasingly, successful ecommerce businesses are finding ways to leverage both models, using dropshipping to test products and expand their catalog while utilizing 3PL services for their proven best-sellers.

As competition in ecommerce intensifies, the businesses that will thrive are those that strategically employ the right fulfillment approach for each product and stage of growth, creating a seamless customer experience regardless of the back-end logistics involved. Understanding the nuances of both dropshipping and 3PL services, and how they can work together, provides a significant competitive advantage in today’s dynamic ecommerce landscape.

Frequently Asked Questions

What is Dropshipping?

Selling products without physical inventory. When an order is placed, the seller creates a Purchase Order for the supplier to ship to the customer directly.

What is a 3PL?

3PLs, (third-party logistics) are warehouses that do not belong to the seller, but the seller uses to store and distribute inventory.

What are the differences between dropshipping and using a 3PL?

Dropshipping means taking orders with no inventory, which can have issues if the supplier has inventory issues. Dropshipping comes from the supplier, which can lead to further distances, and thusly, more costly shipping. 3PLs process orders quickly and effectively.

Up to 64% Lower Returns Processing Cost

Cold Storage Warehouse 3PLs: Specialized Solutions for Temperature-Sensitive Supply Chains

In this article

16 minutes

16 minutes

- Understanding Cold Storage 3PLs

- Definition and Purpose of Cold Storage Warehousing

- Advantages of Cold Storage Solutions

- Comprehensive Cold Chain Services

- Comprehensive International Cold Chain Integrity Shipping

- Addressing Cold Storage Challenges

- Choosing the Right Cold Storage 3PL Partner

- Conclusion

- Frequently Asked Questions

In today’s global supply chain landscape, specialized third-party logistics (3PL) providers offering cold storage capabilities have become essential partners for businesses dealing with temperature-sensitive products. The cold storage market is expected to expand at a CAGR of 9.2% from 2022 to 2030, highlighting its growing significance and popularity. From pharmaceuticals and biologics to fresh produce and frozen foods, these specialized 3PLs ensure product integrity throughout the storage and distribution process.

Understanding Cold Storage 3PLs

Cold storage 3PLs provide specialized warehouse and logistics services designed specifically for temperature-controlled products. Unlike traditional warehousing, cold storage facilities maintain precise temperature ranges to preserve product quality, extend shelf life, and comply with regulatory requirements. Cold storage construction involves creating specialized storage solutions required for temperature-sensitive products, highlighting its significance in the supply chain with unique design considerations and costs that differentiate it from conventional structures.

Definition and Purpose of Cold Storage Warehousing

Cold storage warehousing refers to the specialized storage of perishable goods at controlled temperatures to maintain their quality and extend their shelf life. This type of warehousing is crucial for products that are sensitive to temperature fluctuations, such as food, pharmaceuticals, and certain chemicals. The primary purpose of cold storage warehousing is to provide a consistent and reliable environment that prevents spoilage and damage, ensuring that temperature-sensitive products remain safe and effective throughout their storage period. By maintaining specific temperature conditions, cold storage facilities help businesses comply with regulatory requirements and meet the high standards expected by consumers and industry stakeholders.

Advantages of Cold Storage Solutions

Cold storage solutions offer numerous advantages that are vital for the efficient management of temperature-sensitive supply chains. One of the most significant benefits is the extended shelf life of perishable goods, which reduces the risk of spoilage and waste. This not only improves product quality and safety but also leads to cost savings by minimizing losses. Additionally, cold storage solutions enhance supply chain efficiency by ensuring that products are stored under optimal conditions, which facilitates better inventory management and reduces the likelihood of stockouts or overstocking. Compliance with regulatory requirements is another critical advantage, as cold storage facilities are designed to meet stringent standards for temperature-sensitive products, ensuring that businesses remain compliant and avoid potential penalties.

Comprehensive Cold Chain Services

Modern cold storage 3PLs have evolved well beyond basic refrigerated warehousing to offer sophisticated end-to-end solutions that address every aspect of temperature-sensitive supply chains. They provide extensive cold storage services, leveraging a vast network and advanced capabilities to ensure temperature-controlled warehousing globally. These integrated services ensure product integrity throughout the entire logistics process.

Types of Cold Storage Facilities

Cold storage facilities come in various types, each designed to meet specific temperature requirements for different products:

- Refrigerated Cold Storage Facilities: These facilities maintain temperatures between 32°F and 50°F (0°C and 10°C) and are ideal for storing products that require refrigeration, such as meat, dairy, and fresh produce. The controlled environment helps preserve the freshness and quality of these items.

- Frozen Cold Storage Facilities: Maintaining temperatures below 0°F (-18°C), these facilities are used for storing products that need to be kept frozen, such as frozen foods and certain pharmaceuticals. The ultra-cold environment prevents microbial growth and preserves the integrity of the products.

- Ultra-Low Temperature Cold Storage Facilities: These facilities maintain temperatures below -20°F (-29°C) and are essential for storing products that require extremely low temperatures, such as specific pharmaceuticals and biological samples. The precise temperature control in these facilities ensures the stability and efficacy of highly sensitive products.

Temperature-Controlled Warehousing with Multiple Climate Zones

Today’s advanced cold storage facilities feature precisely engineered environments tailored to specific product requirements:

- Zone Segregation Technology: Modern facilities utilize high efficiency insulated walls, specialized air locks, and positive/negative pressure controls to maintain distinct temperature boundaries between adjacent storage areas while minimizing energy loss during transitions.

- Redundant Cooling Systems: Critical storage zones feature N+1 or N+2 redundancy in refrigeration equipment, with automatic failover capabilities and backup power generation that activates within seconds of utility power loss.

- Microclimate Mapping: Advanced facilities conduct comprehensive thermal mapping studies that identify temperature variations throughout storage spaces, allowing for strategic product placement based on sensitivity. These maps are updated seasonally to account for changing external conditions.

- Customizable Environments: Beyond standard frozen, refrigerated, and ambient zones, leading 3PLs now offer customizable environments with precise control over temperature, humidity, air exchange rates, and even light exposure for especially sensitive products like certain pharmaceuticals, biotechnology materials, and specialty foods. Cold air is essential in these environments to maintain product integrity, and evaporators play a crucial role in circulating this cold air, effectively chilling the environment and the goods within.

- High-Density Storage Solutions: Mobile racking systems designed specifically for cold environments maximize storage capacity while maintaining proper air circulation, reducing the refrigerated footprint and associated energy costs.

Specialized Transportation with Refrigerated Vehicles

Cold chain logistics presents unique challenges that require specialized equipment and expertise. Quality cold chain transportation has advanced significantly to maintain unbroken temperature control:

- Refrigerated Transport Fleets: Modern cold chain 3PLs operate specialized vehicle fleets including multi-temperature trailers capable of maintaining different zones within a single trailer (e.g., frozen, chilled, and ambient sections simultaneously). These vehicles incorporate redundant cooling systems, GPS tracking, and remote temperature monitoring. Many fleets now include hybrid or electric options for last-mile delivery in urban environments.

- Advanced Insulation Technology: Next-generation transport units utilize vacuum-insulated panels and phase-change materials that maintain stable temperatures longer, even during power outages or equipment failure.

- Continuous Temperature Monitoring: Advanced systems now employ multiple sensor points throughout cargo areas, transmitting data at 2-15 minute intervals via cellular or satellite connections. These systems integrate with blockchain platforms to create immutable temperature history records, and AI algorithms analyze patterns to predict and prevent potential excursions before they occur.

- Temperature Validation Procedures: Before loading begins, vehicles undergo pre-cooling to reach the target temperature. Products are equipped with calibrated temperature sensors during loading, and thermal imaging technology verifies proper temperature at critical handoff points. Loading docks feature air curtains and insulated dock seals to prevent temperature excursions during the transfer process.

- Immutable Temperature History Records: AI algorithms analyze patterns to predict and prevent potential excursions before they occur.

- Route Optimization for Temperature Integrity: Specialized routing algorithms account for ambient temperature forecasts, traffic patterns, and delivery time windows to minimize the risk of temperature excursions while optimizing fuel efficiency.

- Last-Mile Solutions: For final delivery, providers now offer options ranging from temperature-controlled vans with compartmentalized storage to specialized thermal packaging designed to maintain temperature for specific delivery window durations.

- Cross-Docking Infrastructure: Purpose-built temperature-controlled cross-docking facilities enable efficient transfer between long-haul and local delivery while maintaining the cold chain, featuring air curtains, rapid-roll doors, and thermal seals for loading docks.

The seamless integration between warehousing and transportation is critical. Modern systems allow for real-time visibility, enabling stakeholders to track both location and temperature conditions throughout the journey. This transparency has become increasingly important as regulatory requirements grow more stringent and consumers demand greater accountability.

Comprehensive International Cold Chain Integrity Shipping

The global movement of temperature-sensitive products presents unique challenges that modern cold storage 3PLs have developed sophisticated solutions to address. International cold chain logistics requires seamless temperature control across multiple transportation modes, handling points, and regulatory environments.

Specialized container technologies include active temperature-controlled containers with autonomous cooling, passive thermal packaging using vacuum-insulated panels and phase-change materials, and hybrid solutions that combine passive insulation with selective active cooling. Multi-modal transport coordination ensures seamless transfers between modes, temperature-mapped trade lanes for seasonal adjustments, and pre-conditioning protocols to stabilize shipments before transit.

Cold storage items require rigorous proof of proper handling and compliance with safety standards. Hence quality assurance and documentation is almost as important as the product itself. Quality assurance needs rigorous temperature mapping validation and clear chain-of-responsibility documentation at each handling point. Compliance with pre-clearance programs, temperature-controlled customs inspections, and global standards such as GDP, IATA, and industry best practices ensures regulatory alignment.

Advanced inventory management uses real-time shelf-life tracking, batch segregation, and temperature-based storage assignments to optimize efficiency and minimize waste. GPS monitoring provides real-time tracking, predictive risk management, and emergency intervention networks to prevent temperature excursions.

These are all unique storage and shipping complications for cold storage items not normally relevant for normal good storage.

Addressing Cold Storage Challenges

Cold storage warehousing presents several challenges that must be addressed to ensure the integrity and safety of temperature-sensitive products. Maintaining consistent temperatures, managing humidity levels, and ensuring proper inventory management are critical aspects of cold storage operations. Additionally, energy efficiency and regulatory compliance are significant concerns that impact both operational costs and the ability to meet industry standards. By understanding and addressing these challenges, businesses can optimize their cold storage processes and maintain the quality of their products.

Common Issues and Concerns in Cold Storage

Cold storage facilities face several common issues and concerns that can impact the quality and safety of temperature-sensitive products. Temperature fluctuations can cause damage to products, compromising their quality and safety. Proper humidity levels are crucial in cold storage to prevent moisture accumulation and condensation, which can lead to product damage and spoilage. Cold storage facilities require significant energy to maintain consistent temperatures, which can increase operating costs and environmental impact.

Efficient inventory management is critical in cold storage to ensure that products are stored and retrieved promptly, preventing overstocking, understocking, and spoilage. Cold storage facilities must comply with various regulatory requirements for temperature-sensitive products, including food safety and pharmaceutical storage standards. Adhering to these regulations is essential to avoid penalties and ensure product safety.

Value-Added Services for Temperature-Sensitive Products

Cold storage 3PLs now offer specialized shipping and handling services that extend well beyond basic storage; temperature-controlled processing areas for product manipulation maintained at appropriate temperatures, eliminating the need to move products to ambient conditions, cold packaging custom packaging services using materials validated for specific temperature ranges, including insulated containers, phase-change materials, and temperature-indicating devices, and cold-rated labeling materials and adhesives designed to maintain integrity in freezer environments, with condensation-resistant properties for items transitioning between temperature zones.

Compliance Management for Regulated Industries

There are many complex regulatory requirements for temperature-sensitive products; confirm your 3PL has the needed industry-specific certifications, such as HACCP, SQF, BRC, GDP (Good Distribution Practice), and specific pharmaceutical requirements from FDA, EMA, and other global regulatory bodies.

Beyond certifications, cold storage 3PLs need validation of monitoring systems according to industry standards, with documented calibration procedures and traceability to national standards and 21 CFR Part 11 compliant systems for industries requiring secure, tamper-evident electronic records with appropriate audit trails and electronic signature capabilities.

Automated generation of compliance documentation in industry-standard formats for submission to regulatory agencies, streamlining reporting processes while ensuring complete data inclusion is highly recommended.

Choosing the Right Cold Storage 3PL Partner

Selecting the optimal cold storage logistics partner represents a critical strategic decision that directly impacts product quality, regulatory compliance, operational efficiency, and customer satisfaction. Being part of professional associations like the American Frozen Food Institute (AFFI) and adhering to industry regulations is essential for ensuring a facility’s trustworthiness and compliance with food safety standards. Here’s a comprehensive framework for evaluating potential cold chain 3PL partners:

1. Temperature Range Capabilities and Stability

Beyond basic temperature classifications, businesses should conduct detailed evaluations of 3PL’s Temperature Mapping Documentation. Request comprehensive temperature mapping studies of potential facilities, including seasonal variations, recovery times after door openings, and identification of any hot/cold spots within storage areas to ensure the 3PL meets your cold storage requirements.

Evaluate historical temperature excursion data over multiple years, including duration, magnitude, and resolution response times. Leading providers maintain excursion rates below 0.1% of total monitored hours. Assess the provider’s approach to regular stability testing, including frequency of recalibration for monitoring systems and validation procedures for new storage areas or equipment.

Determine whether the provider can accommodate specialized temperature requirements outside standard ranges, such as ultra-low temperature storage (-80°C) for certain biologics or precise temperature control for pharmaceutical stability testing if needed.

Examine data on temperature recovery times following routine operations like loading/unloading or maintenance activities, which indicates the robustness of cooling systems.

2. Regulatory Compliance History and Certifications

A provider’s compliance history offers critical insights into their operational discipline. Verify relevant certifications appropriate to your industry, which might include BRC Global Standard for Storage and Distribution, ISO 9001, HACCP certification, FDA registration, or pharmaceutical-specific certifications like GDP (Good Distribution Practice).

Request summaries of recent regulatory inspections and third-party audits, including any observations or findings and, crucially, the corrective actions implemented in response. Evaluate the structure and effectiveness of the provider’s internal compliance department, including staffing ratios, qualification requirements, and authority within the organization. Assess the maturity of quality management systems, including change control procedures, deviation management, and documentation practices that would support your compliance requirements.

Finally, review the frequency and depth of regulatory training provided to staff, including how training effectiveness is measured and verified.

3. Technology Infrastructure and Monitoring Systems

Modern cold chain logistics requires sophisticated technological capabilities. Evaluate the design of temperature monitoring systems, including sensor redundancy, backup power supplies, and alert escalation protocols. Leading providers employ multiple independent monitoring systems as a safeguard against single-point failures.

Assess how monitoring data is made available to clients, including real-time dashboard capabilities, API integration options with client systems, and historical data retrieval functionality. Review security protocols protecting monitoring systems and client data, including penetration testing history, access controls, and security incident response procedures.

For regulated industries, verify the existence of computer system validation according to GAMP 5 or similar standards, ensuring that monitoring systems are demonstrably reliable for regulatory purposes.

4. Geographic Coverage and Transportation Network

Logistics network capabilities significantly impact service levels and risk profiles. Unlike standard products, 3PL locations need to be evaluated against your manufacturing sites, key suppliers, and customer destinations to minimize transit times and handoff points. Confirm whether the provider operates their own temperature-controlled transportation fleet or relies on partners; directly controlled assets often provide more consistent temperature management.

Review performance data for final delivery operations, including on-time delivery rates, temperature compliance during the critical last mile, and customer satisfaction scores. Evaluate the provider’s ability to reroute shipments or relocate inventory in response to facility issues, weather events, or other disruptions that might impact a single location.

5. Industry-Specific Experience and Expertise

Specialized knowledge significantly enhances operational performance. Identify the percentage of the provider’s business dedicated to your specific industry, as this often correlates with their depth of relevant expertise and processes tailored to your needs.

Assess whether the provider has established handling procedures specific to your product types, such as specialized procedures for vaccines, cell therapies, or delicate food products. Review the provider’s involvement in industry-specific organizations and standards committees, which often indicates commitment to best practices and awareness of emerging trends.

Request detailed case studies and client references specific to your industry, including examples of how they’ve solved challenges similar to those you might face.

6. Contingency Planning and Backup Systems

Robust backup systems and emergency preparedness are essential for cold chain integrity. Evaluate backup power generation capacity, including regular testing protocols, fuel supply agreements, and automatic transfer switch testing. Leading providers maintain generator capacity to power 100% of critical systems indefinitely.

Review the structure and training of emergency response teams, including 24/7 availability, decision-making authority, and regular drill frequency. Assess redundancy in cooling infrastructure, including N+1 or N+2 redundancy planning, preventive maintenance programs, and mean time to repair metrics for critical equipment.

Evaluate procedures for responding to temperature excursions, including product rescue capabilities, alternative storage arrangements, and transportation contingencies. Review notification procedures for emergencies, including escalation pathways, client communication templates, and service level agreements for different types of incidents.

7. Sustainability Practices and Energy Efficiency

Environmental performance increasingly impacts both cost structure and corporate sustainability goals. Compare energy usage per cubic foot of cold storage space against industry benchmarks, as well as trends showing improvement over time.

Assess the provider’s transition status to low-global warming potential refrigerants and leak detection/prevention programs, which impacts both environmental footprint and regulatory compliance. Evaluate the percentage of operations powered by renewable energy sources, including on-site generation and renewable energy credits.

Review water usage for cooling towers and other systems, including recycling programs and efficiency improvements and assess programs for reducing packaging waste, managing product obsolescence, and diverting operational waste from landfills.

Conclusion

As supply chains grow increasingly complex and consumer expectations for quality continue to rise, specialized cold storage 3PLs have become essential partners for businesses handling temperature-sensitive products. Beyond basic warehousing and transportation, networks like Cahoot offer expertise, technology, and purpose-built infrastructure that can support and ensure product integrity throughout the distribution lifecycle regardless of your specialized needs, be it cold storage, electronics, cosmetics, or anything else.

By leveraging the specialized capabilities of cold storage 3PLs, organizations can focus on their core competencies while gaining access to best-in-class cold chain management. The result is enhanced product quality, reduced waste, stronger compliance, and ultimately, greater customer satisfaction.

For businesses dealing with temperature-sensitive products, the right cold storage 3PL isn’t merely a service provider; they’re a strategic partner in delivering quality, compliance, and competitive advantage in an increasingly demanding marketplace.

Frequently Asked Questions

What Types of Products Need to be Stored in a Cold Storage Facility?

Fresh produce, meat, seafood, dairy products, frozen foods, pharmaceuticals commonly require specific temperature control.

How Do You Ensure Product Quality During Cold Storage?

Continuous temperature monitoring systems, regular quality checks, proper handling procedures, and adherence to industry standards maintains product quality during storage.

What Certifications are Needed to Ensure Cold Storage Food Safety and Quality?

Depending on the industry, certifications like BRCGS, FDA, or GMP may be required.

Up to 64% Lower Returns Processing Cost

Finding the Right 3PL Partner for Consumer Electronics Fulfillment | Cahoot

In this article

9 minutes

9 minutes

- Understanding the Complexities of Consumer Electronics Fulfillment

- Why Choose a 3PL Partner for Consumer Electronics Fulfillment?

- Key Services Provided by 3PLs in the Electronics Industry

- Opportunities Created by Outsourcing Fulfillment

- Potential Drawbacks of 3PL Partnerships

- Choosing the Right 3PL Partner for Your Business

- Conclusion

- Frequently Asked Questions