Why Peer-to-Peer Returns is the Next Big Thing in Retail Sustainability

Last updated on April 16, 2025

In this article

6 minutes

6 minutes

- The Broken Economics of Traditional Returns

- Peer-to-Peer Returns: What It Is and How It Works

- Why Now? Perfect Storm of Retail Disruption

- The Bigger Picture: Connecting Thrifting to Logistics Innovation

- Tech That Makes It Possible

- Strategic Advantages for Retailers

- Who’s Doing It Now?

- Challenges to Consider

- The Future: Circular, Connected, Customer-First

- Peer-to-Peer Returns vs. Traditional Returns

- Final Thought

- Frequently Asked Questions

In an era of rising costs, shifting consumer values, and intensifying environmental scrutiny, the way retailers handle returns is under the microscope. The traditional returns model is expensive, slow, and environmentally destructive, and is being outpaced by more nimble, sustainable alternatives. At the forefront of this evolution is peer-to-peer (P2P) returns, a logistics innovation that allows returned products to be sent directly from one customer to the next buyer.

This isn’t just a clever idea—it’s a fundamental rethinking of reverse logistics, and it may be the most impactful change to hit retail supply chains in decades.

The Broken Economics of Traditional Returns

E‑commerce return rates now average 20% to 40%, with fashion and footwear brands absorbing some of the highest costs. That’s double or triple the rate of brick-and-mortar stores. Brands are being crushed by the financial weight of reverse shipping, repackaging, restocking, and often, liquidation or disposal.

Returns are no longer a customer service cost; they’re a strategic liability.

- Nearly $900 billion in merchandise was returned in the U.S. in 2022 alone (NRF).

- Reverse logistics can consume up to 21% of total supply chain costs.

- Only about 50% of returned goods are resold at full value.

But it’s not just a financial problem. Each return shipped back to a warehouse represents wasted packaging, transportation emissions, and time-sensitive inventory that often goes unsold and ends up in a landfill.

Peer-to-Peer Returns: What It Is and How It Works

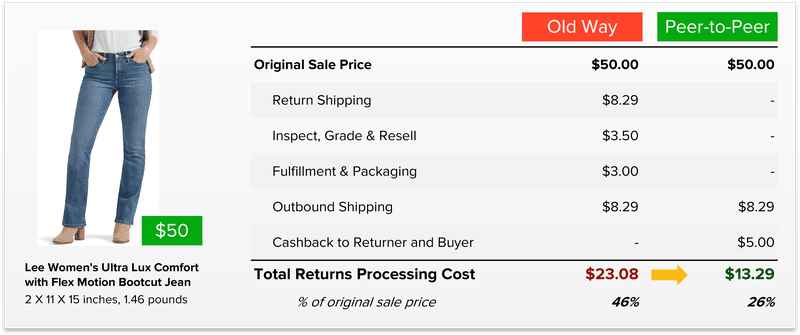

Peer-to-peer (P2P) returns flip the script by rerouting returned items directly from one customer to the next buyer, bypassing the retailer’s warehouse entirely.

Example:

Amy in Los Angeles, CA, returns a pair of jeans. Instead of shipping them back to the brand’s warehouse in Dallas, TX, a P2P system identifies a new buyer—Sarah in Casper, WY. Amy ships directly to Sarah. The brand handles the refund and inventory update digitally, all without the jeans going to waste or the seller having to touch them again.

The Benefits

- ✅ 64% lower cost per return (Cahoot data)

- 🚚 4× faster resale turnaround

- 🌍 2× reduction in carbon footprint (minimum)

- ♻️ Significantly less disposal and warehouse congestion

Why Now? Perfect Storm of Retail Disruption

1. Economic Volatility and Tariff Pressure

Recent tariff escalations—particularly under the 2025 trade policy agenda—have dramatically increased costs for imported goods, especially apparel from China. Brands reliant on low‑cost imports are feeling the squeeze as COGS climbs and shoppers resist higher prices.

P2P returns create a domestic redistribution layer, decoupled from global supply chains and insulated from trade disputes.

2. Rising Gen Z and Millennial Expectations

Today’s consumers value transparency, sustainability, and personalization. They’re comfortable with secondhand goods and expect brands to support a circular economy.

A staggering 68% of Gen Z consumers have purchased a pre‑owned item in the past year. They view circular shopping not as a compromise, but as a cultural norm.

“Today’s consumers don’t just want fast or free, they want ethical, efficient, and intelligent,” says Manish Chowdhary, Founder and CEO of Cahoot.

3. Environmental Urgency

Returns generate over 15 million metric tons of CO₂ emissions annually in the U.S. P2P models dramatically reduce transport distances, energy use, and landfill waste. In a climate‑conscious market, that’s a strategic differentiator.

The Bigger Picture: Connecting Thrifting to Logistics Innovation

To understand why peer-to-peer returns are gaining traction, consider the broader cultural and economic shift. Gen Z and Millennials are reshaping consumption: they prefer access over ownership, value over status, and sustainability over excess.

Peer-to-peer returns are the invisible backbone of this transformation. Much like Poshmark and Depop connect resellers and buyers, P2P returns introduce fluidity into e‑commerce, reducing friction, recovering value, and mirroring how people already engage with goods—agilely, communally, and with minimal waste.

This is where recommerce and reverse logistics converge. Resale and returns, once managed separately, are merging into one holistic circular ecosystem optimized for both financial and environmental performance.

Tech That Makes It Possible

- AI Matching – Identifies SKUs, sizes, and proximity matches in real time.

- Photo & Rating Verification – Maintains trust between sender and new buyer.

- Smart Labeling & Routing – Automates shipping based on live demand.

- Customer Identity Portability – Builds trust profiles like those on Airbnb and Uber.

Platforms such as Cahoot, Recurate, and Trove are embedding these capabilities into their networks, making P2P both possible and profitable.

Strategic Advantages for Retailers

- Profit Recovery: Cuts restocking and shipping costs.

- Customer Retention: Incentivizes returns through store credit or cashback.

- Inventory Fluidity: Speeds resale of seasonal or trending items.

- Brand Loyalty: Demonstrates a commitment to sustainability.

Peer-to-peer returns transform a sunk cost into a circular transaction.

Who’s Doing It Now?

- Cahoot: Pioneering peer-to-peer fulfillment and returns.

- REI & Patagonia: Piloting resale and trade‑in programs with potential P2P extensions.

- Recurate: Integrated resale and P2P for brands like Steve Madden and Cotopaxi.

- The RealReal: Luxury recommerce leader using AI authentication.

Challenges to Consider

- Trust: Will customers accept goods from other customers?

- Returns Triage: Not all items qualify; brands need a hybrid model.

- Logistics Support: Requires rethinking fulfillment, packaging, and service workflows.

- UX Consistency: Ensuring P2P experiences match the core brand promise.

None of these barriers are insurmountable. With clear standards, robust tech, and the right incentives, P2P can scale elegantly.

The Future: Circular, Connected, Customer‑First

Peer-to-peer returns are the next logical step in circular retail. They offer a sustainable, scalable, and consumer‑aligned solution to one of retail’s most painful problems. Forward‑thinking brands are already acting; those who wait may find themselves at a competitive and cultural disadvantage.

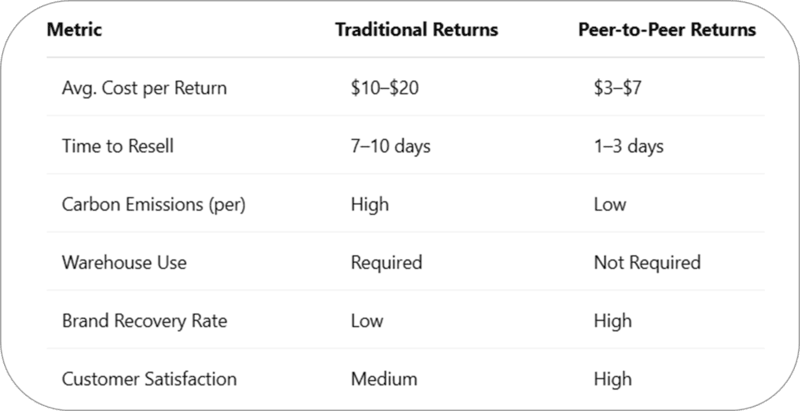

Peer-to-Peer Returns vs. Traditional Returns

Final Thought

Returns have always been the retail elephant in the room: expensive, wasteful, yet unavoidable. Peer-to-peer returns finally offer a model that’s smarter, cleaner, and aligned with how people shop today.

“Retailers that embrace peer-to-peer will discover that returns aren’t a liability—they’re a platform for innovation,” says Manish Chowdhary. “This is how we build a future where commerce and sustainability truly coexist.”

Frequently Asked Questions

Can peer-to-peer returns become the norm, not the exception?

Yes. Just as peer-to-peer marketplaces have redefined buying, the same mindset is now shaping returns. It reflects the shift from centralized, industrial systems to decentralized, digitally coordinated networks. Returns are no longer a dead end; they’re a point of redistribution.

What role does consumer trust play in scaling P2P returns?

Trust is critical but achievable. Just as ridesharing normalized getting into a stranger’s car, P2P commerce relies on ratings, AI verification, and transparency. Retailers must build trust into the experience, not around it.

Is P2P compatible with luxury or premium brands?

Absolutely. The RealReal and StockX have shown that trust, transparency, and resale value are central to modern luxury. P2P returns offer luxury brands a way to maintain equity while reducing costs and waste.

How does peer-to-peer returns strengthen supply chain resilience?

By creating a flexible, decentralized return path, P2P models reduce reliance on centralized warehouses and long‑haul freight—especially valuable during peak seasons, economic volatility, or shipping disruptions.

What mindset shift is needed for retail executives to embrace P2P?

Retail leaders must stop viewing returns as isolated losses and start treating them as recoverable assets. With the right tech and policy, a return isn’t the end of a transaction—it’s the beginning of another. That’s the real power of peer-to-peer.

Up to 64% Lower Returns Processing Cost