The Evolution of Thrifting: Why Secondhand Shopping Has Gone Mainstream

Last updated on April 16, 2025

In this article

11 minutes

11 minutes

- From “Thrift Shame” to “Treasure Hunt”: How We Got Here

- What’s Fueling the Secondhand Surge?

- Not Just Clothes: Recommerce is Expanding

- Brands Are Getting Involved, And Winning

- Tariffs, Trade, and the Return of the Local Supply Chain

- Challenges Ahead: Will It Scale?

- Retail Takeaways: What Leaders Need to Do Now

- Resale vs. Retail – By the Numbers

- Final Thought

- Glossary: Recommerce Terms You Should Know

- Frequently Asked Questions

Once relegated to church basements and garage sales, secondhand shopping has officially gone prime time. What was once a necessity-driven, fringe behavior is now a flourishing multi-billion-dollar industry driven by value-seeking consumers, climate-aware shoppers, and tech-savvy Gen Z and Millennial buyers who wear their thrift finds as a badge of honor.

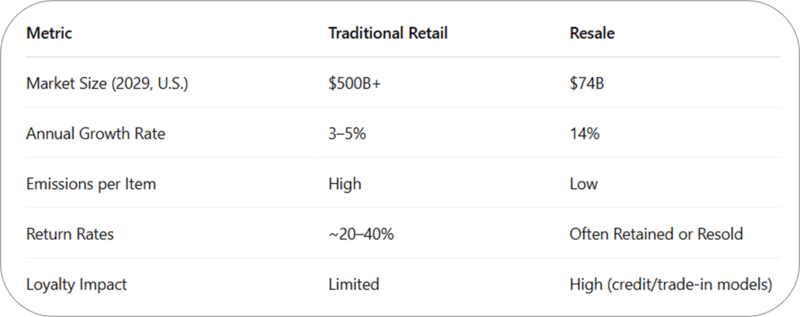

In the U.S., resale is experiencing a meteoric rise. The secondhand apparel market alone grew 14% in 2024, five times faster than the broader apparel sector, and is expected to top $74 billion by 2029. Globally, it’s projected to reach $367 billion. What’s driving this explosive growth? A perfect storm of economic pressure, shifting cultural norms, sustainability concerns, and the digitization of everything from neighborhood thrifting to luxury resale.

For retail executives and brand leaders, the message is clear: resale isn’t cannibalizing your customer base, it’s reshaping it. Understanding this cultural shift is no longer optional; it’s essential.

From “Thrift Shame” to “Treasure Hunt”: How We Got Here

The image makeover of secondhand shopping over the past decade is nothing short of remarkable. What was once associated with financial hardship has been reframed as smart, stylish, and sustainable. Social media has supercharged this transformation. A single TikTok thrift haul can rack up millions of views, turning vintage shopping into a viral aesthetic. On Depop, a Gen Z-favorite resale platform, sellers often model their items themselves, cultivating loyal followings around curated closets.

According to Morning Consult, about half of Americans now shop secondhand regularly, and nearly 1 in 4 have sold an item secondhand in the past three months. Among Millennials and Gen Z, the adoption rate is even higher, with over two-thirds of young adults purchasing used items last year.

“Secondhand is no longer a fallback,” says Alon Rotem, Chief Strategy Officer at ThredUp. “It’s a first-stop shop for the modern consumer.”

What’s Fueling the Secondhand Surge?

1. Economic Pressures Make Resale Look Smart

Amid inflation, rising interest rates, and growing concern about household debt, consumers are tightening their belts and looking for value. For price-sensitive generations raised in the aftermath of the 2008 recession and the financial disruptions of the pandemic, secondhand shopping isn’t just about affordability—it’s about economic resilience.

A record 58% of U.S. consumers cited the cost-of-living crisis as a motivator for secondhand purchases in 2024. With new imported apparel prices rising, especially due to recent tariffs on Chinese goods, secondhand becomes even more competitive. Thrift finds are not just cheaper; they’re often higher quality than mass-produced fast fashion alternatives.

As Manish Chowdhary, Founder and CEO of Cahoot, puts it: “When prices rise and new inventory becomes more expensive or delayed, secondhand offers a faster, cheaper, and more sustainable supply chain. It’s not just a workaround, it’s a strategic alternative.”

2. Sustainability Has Become Personal

Younger generations are deeply concerned about climate change, and they’re expressing it through their wallets. Fast fashion is increasingly viewed as wasteful and unethical, while secondhand shopping is seen as a form of activism.

In fact, nearly half of Gen Z and Millennials now consider resale value when making a purchase. They understand that a $15 thrifted Levi’s jacket has residual value, while a $7 fast fashion top may end up in a landfill. The resale economy empowers them to be both budget-conscious and climate-conscious.

Buying used is increasingly framed as a responsible lifestyle choice. Social movements like the Circular Economy and #SlowFashion are giving consumers new ways to engage with brands and expect more from them.

3. Uniqueness and Self-Expression

Gen Z isn’t interested in looking like everyone else. Resale offers one-of-a-kind finds that can’t be replicated at the mall. Vintage ’90s jeans, old-school band tees, and retro designer handbags give them an edge and a story to tell.

Nearly half of younger consumers say they shop secondhand for “unique” items that help express their personal style. Unlike mass-market trends, thrifting allows consumers to build wardrobes and homes with character. Platforms like Depop, Poshmark, and 1stDibs are built around discovery and community, turning shopping into storytelling.

4. Digitization and Convenience

A decade ago, thrifting required time, luck, and in-person exploration. Today, you can scroll through thousands of curated listings, filter by size, and check out in seconds. AI-powered platforms like ThredUp now offer visual search and dynamic pricing. Tools like Smart Listing on Poshmark help sellers optimize their listings, while AI authentication ensures buyers are getting the real deal on platforms like The RealReal and StockX.

Modern resale has the polish of traditional ecommerce, and often better UX.

Not Just Clothes: Recommerce is Expanding

While apparel leads the way, resale is growing across verticals:

- Furniture & Home Décor: Platforms like Facebook Marketplace, AptDeco, and 1stDibs are booming as shoppers furnish homes with affordable or vintage items.

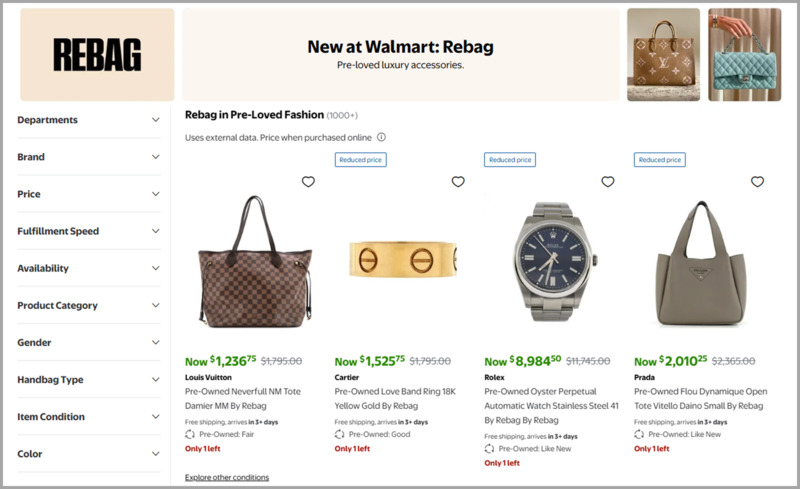

- Luxury Goods: The RealReal, Rebag, and Vestiaire Collective offer authenticated pre-owned fashion and jewelry with white-glove service.

- Electronics & Media: eBay, Gazelle, and Back Market cater to shoppers looking for refurbished tech.

This diversification shows that resale is no longer a niche; it’s a cross-category movement.

Brands Are Getting Involved, And Winning

Retailers are no longer watching from the sidelines. Over 75% of major brands are either exploring or actively building resale programs. From trade-in initiatives (Patagonia’s Worn Wear, REI Re/Supply) to peer-to-peer resale on brand sites (Rachel Comey, Hanna Andersson), brands are turning recommerce into a loyalty driver and sustainability differentiator.

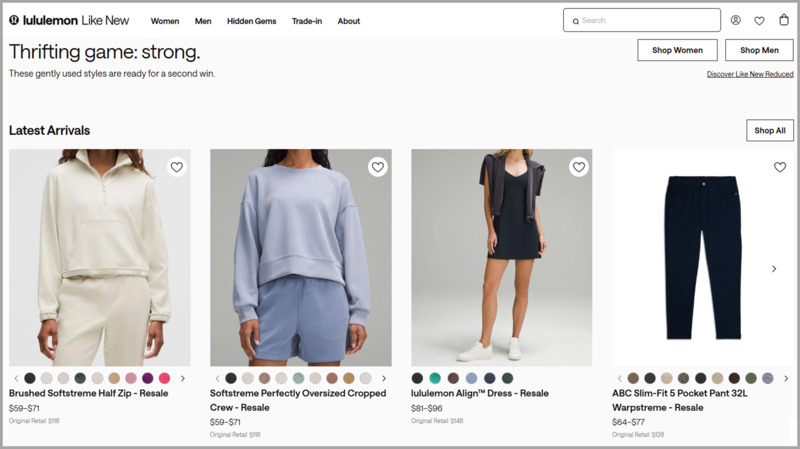

Lululemon’s “Like New” program is an early success story. Customers trade in lightly used gear for credit, and the brand resells it online. In return, Lululemon gains customer retention, deeper engagement, and new revenue streams, all while reinforcing its commitment to sustainability.

Even Walmart has gotten in on the game, partnering with Rebag to sell pre-owned luxury handbags on its site, proving that resale now appeals across price points and retail formats.

Tariffs, Trade, and the Return of the Local Supply Chain

With rising tensions around Chinese imports and efforts to close tax loopholes exploited by ultra-cheap players like Shein and Temu, new apparel is becoming more expensive and politically charged. The resale market sidesteps these supply chain vulnerabilities. As Rotem of ThredUp notes, “All of the clothing comes from the closets of Americans.”

Recommerce essentially “domesticates” the supply chain. Brands and platforms that embrace this model gain independence from volatile global trade routes, and potentially from looming environmental regulations around overproduction.

Challenges Ahead: Will It Scale?

Despite the momentum, resale isn’t frictionless. Processing single-SKU, one-off products is operationally messy. Trust and quality control remain concerns. Margins can be tight, especially for managed resale services. And a deep recession could simultaneously increase supply (more people selling) and suppress demand (less discretionary spending).

Still, the trendlines are clear. Shoppers want alternatives, and for brands, recommerce offers resilience in pricing, supply, sustainability, and customer loyalty.

Retail Takeaways: What Leaders Need to Do Now

- Understand your resale customer. They’re already buying and selling your products. Are you enabling them? Or ignoring them?

- Audit your supply chain for circularity: Can your products support second, third, or fourth lives?

- Explore RaaS partnerships (Resale-as-a-Service): Trove, Recurate, Archive, and ThredUp can help launch resale with minimal lift.

- Integrate resale into your CX: Consider buy-back incentives, branded resale platforms, and Peer-to-Peer Return options.

- Start with SKUs that make sense: Apparel, accessories, gear, and standardized home goods are ideal starting points.

5 Brands Getting Resale Right

- Patagonia – Worn Wear encourages durability and trade-ins.

- REI – Re/Supply processes thousands of returned items into fresh inventory.

- Lululemon – “Like New” generates loyalty and promotes quality.

- Rachel Comey – Peer-to-peer resale via Recurate integration.

- Athleta – Partnered with ThredUp to launch “Athleta Preloved.”

Resale vs. Retail – By the Numbers

Final Thought

The next decade of retail will be defined not just by what’s new, but by how we handle what’s already been made. Jeremy Stewart, Head of Customer Success at Cahoot, believes that “Recommerce is not a disruption, it’s an evolution. The brands that thrive will be those who view returns, resale, and reverse logistics not as cost centers, but as opportunities to connect, conserve, and compete.”

The closet is open. Are you ready for it?

Glossary: Recommerce Terms You Should Know

🔄 Recommerce

Short for “reverse commerce,” recommerce refers to the buying and selling of pre-owned, returned, or surplus goods. It includes secondhand, vintage, refurbished, and resale items, and is central to the circular economy movement.

🛍️ Resale-as-a-Service (RaaS)

A business model that allows brands to launch and manage their own resale programs using third-party tech and logistics providers. RaaS platforms handle authentication, fulfillment, pricing, customer service, and returns. Leading providers include Trove, Recurate, Archive, and ThredUp.

🔁 Circular Economy

An economic model that aims to eliminate waste and maximize the lifecycle of products by keeping them in use through reuse, resale, recycling, or refurbishment. Recommerce is a key pillar of circular retail strategy.

👗 Bracketing

A common ecommerce practice where customers buy multiple sizes or colors of the same item with the intention of returning those that don’t fit or suit them. Bracketing contributes to high return rates, especially in fashion retail.

📦 Reverse Logistics

The process of moving goods from customers back to the seller or manufacturer, often for return, repair, or resale. Traditional reverse logistics can be costly and environmentally taxing; peer-to-peer returns streamline this process.

🤝 Peer-to-Peer (P2P) Returns

A logistics innovation where a returned product is routed directly from one customer to another, bypassing the brand’s warehouse, to reduce shipping costs, emissions, and processing time. Companies like Cahoot are pioneering this model for scalable circularity.

🧾 Buy-Back Program

A retailer-led initiative that invites customers to return used items (often for store credit or cash) so they can be cleaned, verified, and resold. Examples: Lululemon Like New, Patagonia Worn Wear.

💼 Trade-In Program

Similar to a buy-back, but typically focused on higher-value goods (e.g., electronics, luxury fashion, outdoor gear). Items are traded in for credit or resale eligibility and then processed via a recommerce channel.

🔍 Authentication

The process of verifying the legitimacy and condition of pre-owned items—especially luxury goods—before resale. It is often powered by AI (e.g., Entrupy) or expert inspection. It builds buyer trust and ensures resale value.

📈 Net Recovery Rate

The percentage of a returned or resold item’s original retail value that a retailer or recommerce partner can recover through resale. A key KPI for evaluating the efficiency and profitability of circular programs.

📊 Resale Value Consciousness

A consumer mindset in which the anticipated resale value of a product influences the initial purchase decision, especially common among Gen Z and Millennials who view fashion as an asset rather than an expense.

Frequently Asked Questions

How are rising tariffs influencing the long-term economics of new vs. secondhand retail goods?

Tariffs on imported goods, particularly fast fashion and consumer products from low-cost countries, are driving COGS up substantially. For retailers, this makes resale more than just a sustainability story—it becomes a margin play. When the price gap between new and secondhand shrinks, recommerce emerges as a viable buffer strategy. Brands that integrate resale now can insulate themselves from future geopolitical pricing shocks.

What does secondhand shopping reveal about the shifting values of Gen Z and Millennials?

Younger generations are not just frugal—they’re value driven. They want products that reflect their beliefs: sustainability, authenticity, and individuality. Secondhand enables them to reject mass consumption while expressing personal style. For retailers, it’s not just about offering “cheaper stuff”; it’s about enabling self-expression with meaning. Recommerce is not just a revenue channel; it’s a brand alignment opportunity.

How can brands embrace resale without cannibalizing their primary business model?

The misconception that resale erodes new product sales misses the broader picture: resale extends the customer lifecycle. When done right, resale drives acquisition, improves retention, and enhances brand perception. Circular strategies like trade-ins and peer-to-peer returns build ecosystem loyalty. Think of it not as cannibalization, but as ecosystem optimization—your customer is shopping somewhere; make sure it’s still within your brand’s orbit.

Why is recommerce considered part of supply chain resilience in 2025 and beyond?

With global supply chains strained by tariffs, climate events, and transportation costs, recommerce offers a rare thing: a domestic, distributed inventory pool that does not rely on cross-border shipping. Resale platforms are becoming a decentralized warehouse network. That’s not just green—it’s strategic infrastructure. Brands that build a circular foundation today will be better equipped for tomorrow’s volatility.

Could resale, thrift, and peer-to-peer models become the default, not the exception, in 10 years?

Absolutely, and it’s already happening. With resale growth outpacing traditional retail and platforms like ThredUp, Depop, and Cahoot building robust ecosystems, the future points to a blended model. New, used, repaired, returned, and rerouted items will all live in the same customer journey. The shift isn’t just about price—it’s about designing a system that wastes less, serves more, and adapts faster.

Up to 64% Lower Returns Processing Cost